Tutorial on Three Outside Down Candlestick Pattern

The three outside down candlestick is a bearish reversal with a good record of reversing the upward price trend. It has a frequency ranking of 21, so you will be able to find it easily enough in a historical price trend or in real time.

Bearish Three Outside Down Candlestick Patterns Forex Patterns YouTube

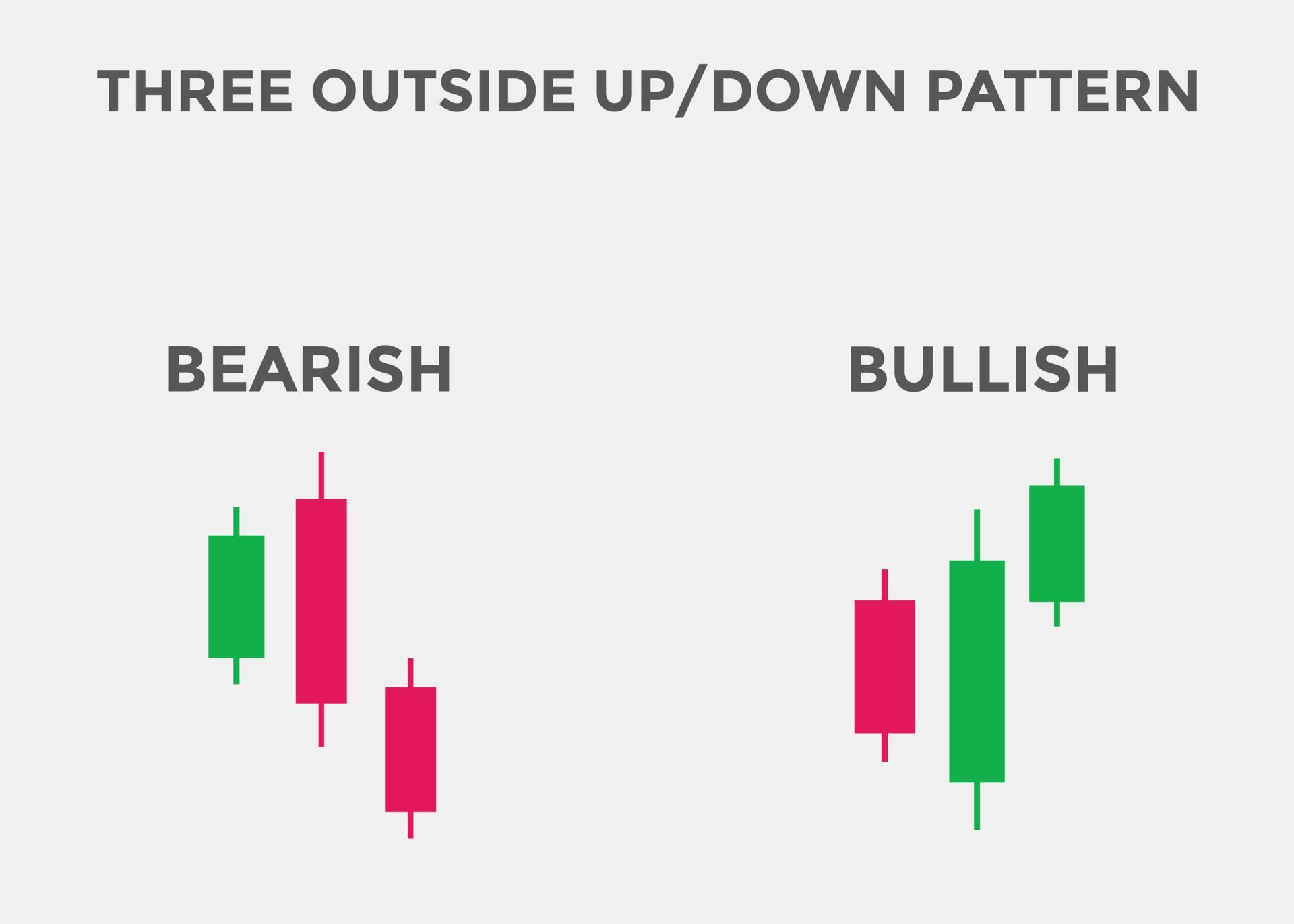

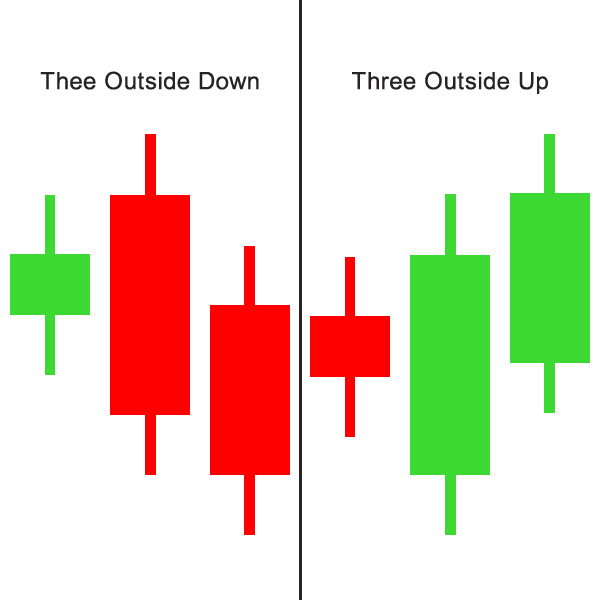

Three outside up/down are patterns of three candlesticks that often signal a reversal in trend. The three outside up and three outside down patterns are characterized by one.

Three Outside Up Candlestick Pattern With Trading Strategy

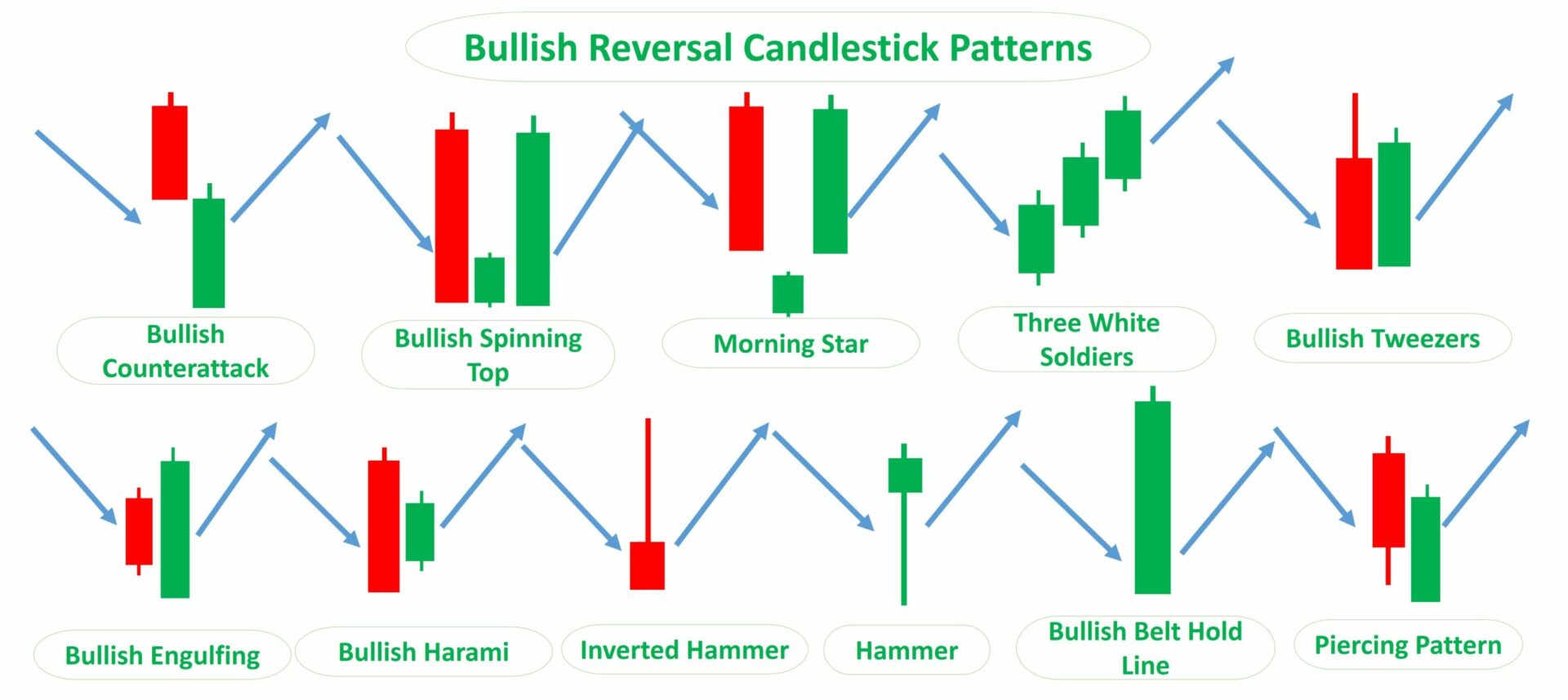

The Three Outside Up pattern is a three-line pattern being an extension of the two-line Bullish Engulfing pattern. The pattern was introduced by Morris, and his intention was to improve the two-line pattern performance. The third candle is meant to behave as a confirmation of the Bullish Engulfing.

Reversal Three Inside Outside Up and Down Candlestick Pattern Best Forex Brokers For

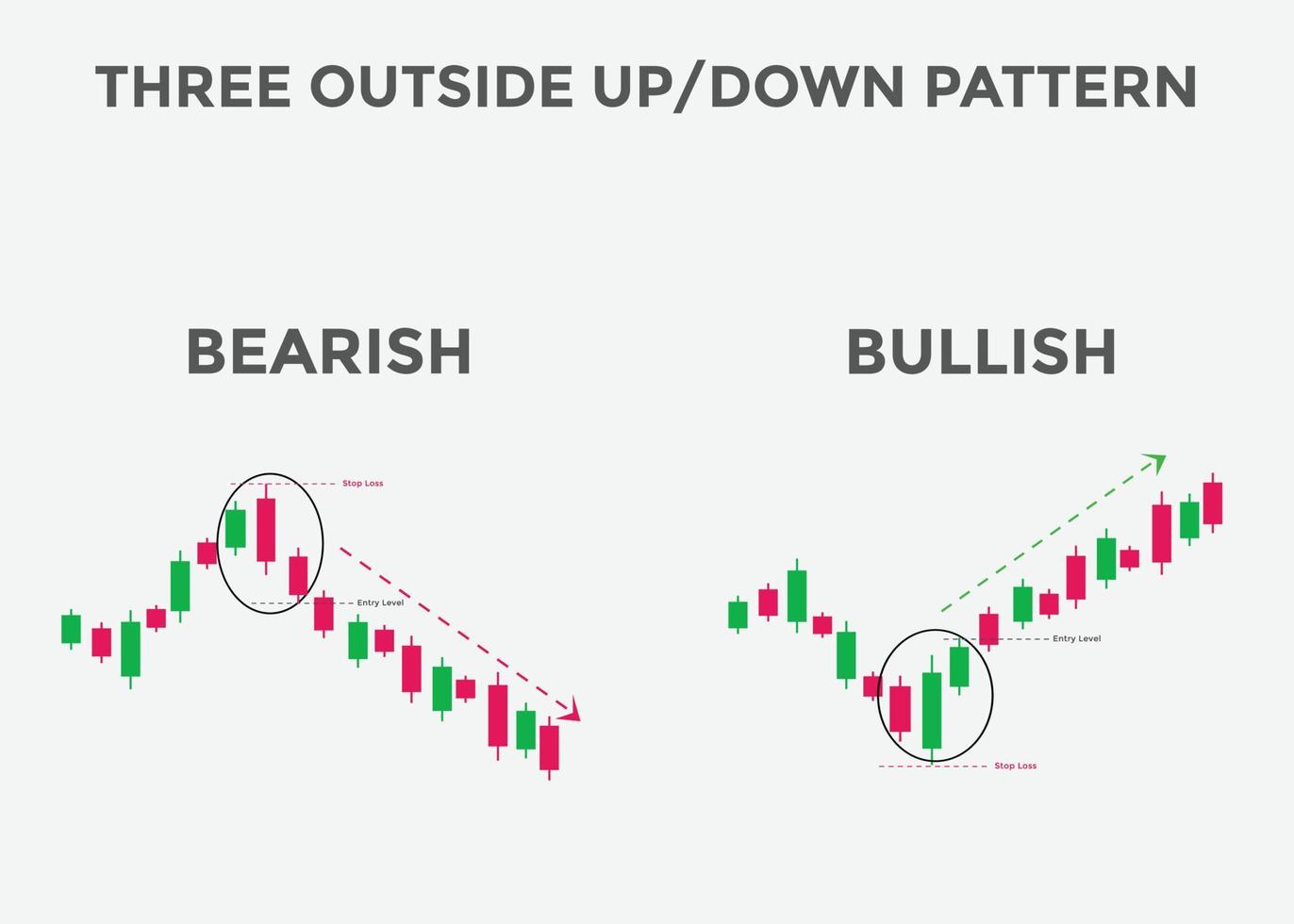

The Three Outside Up & Down candlestick patterns are 3-bar opposite reversal patterns. They are made of one up or down candle and then 2 candles of the opposite color. The second candle contains the first one. The third candle closes over (for the bullish formation) or below (for the bearish one) the second one.

Three outside up and down candlestick pattern. Candlestick chart Pattern For Traders. Powerful

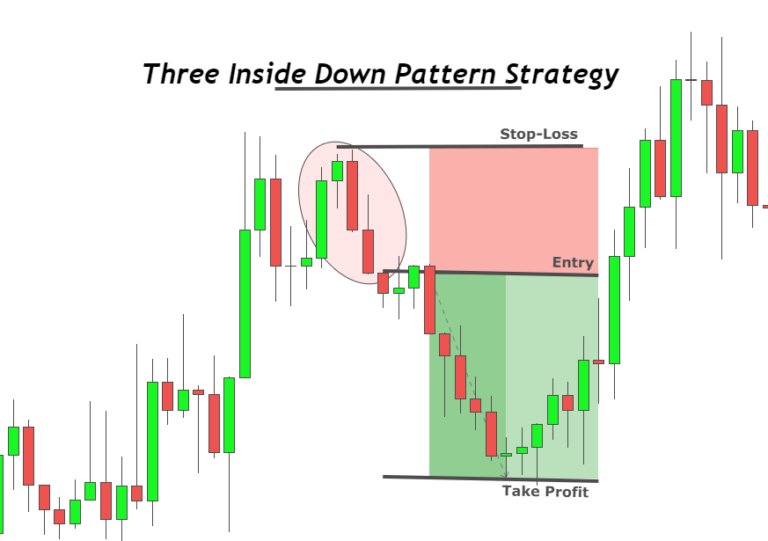

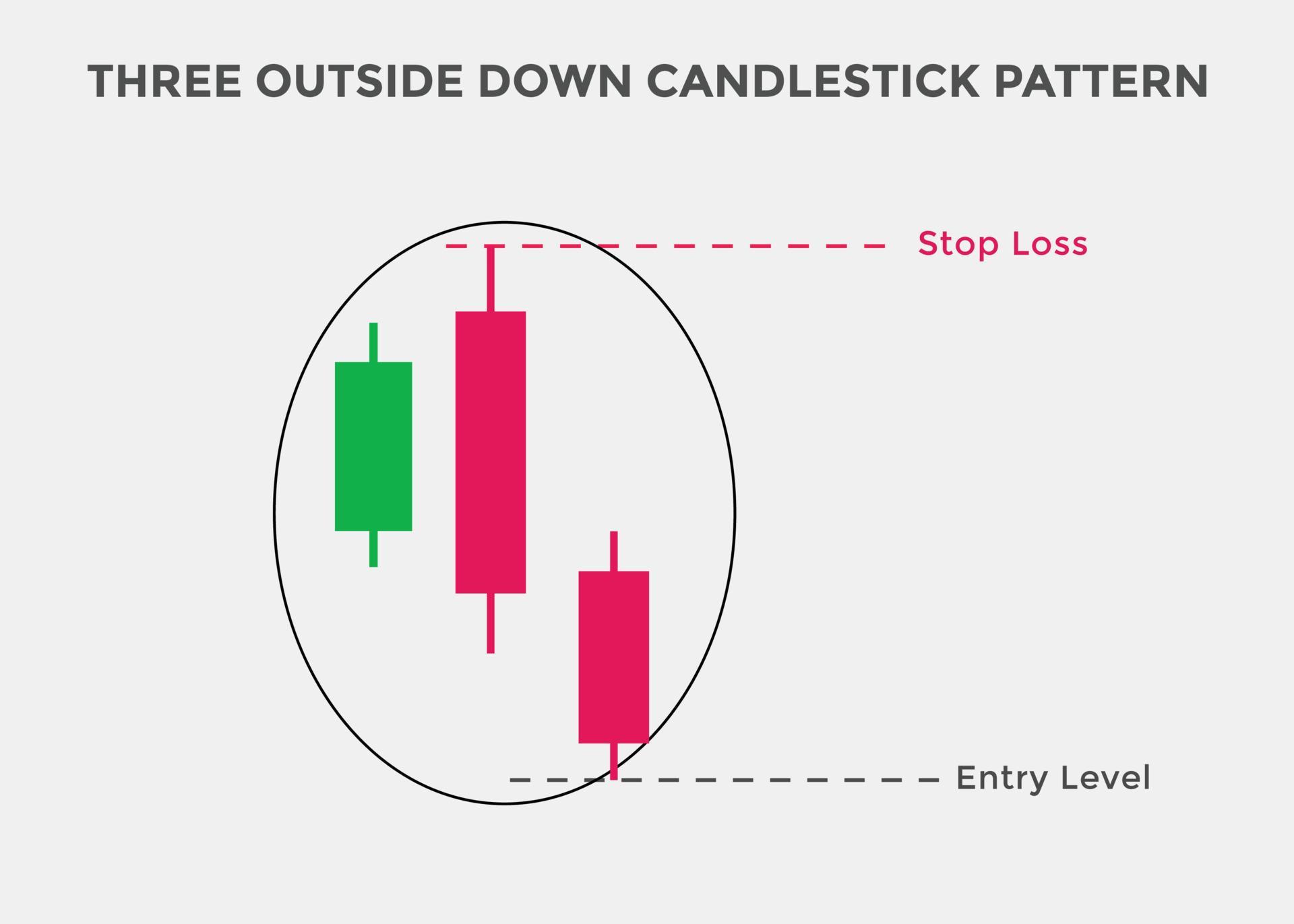

The three outside down candlestick pattern is a valuable tool for traders and investors to identify potential bearish reversals in the market. This pattern, composed of three consecutive candlesticks, typically forms at the end of an uptrend or during an extended price rally in a downtrend.

Trading Patterns Including Three Candlesticks

#candlestick #trading #chartpatterns -----Website: https://www.boomingbulls.comEnquiry / Suggestions: [email protected].

An Overview of Triple Candlestick Patterns Forex Training Group

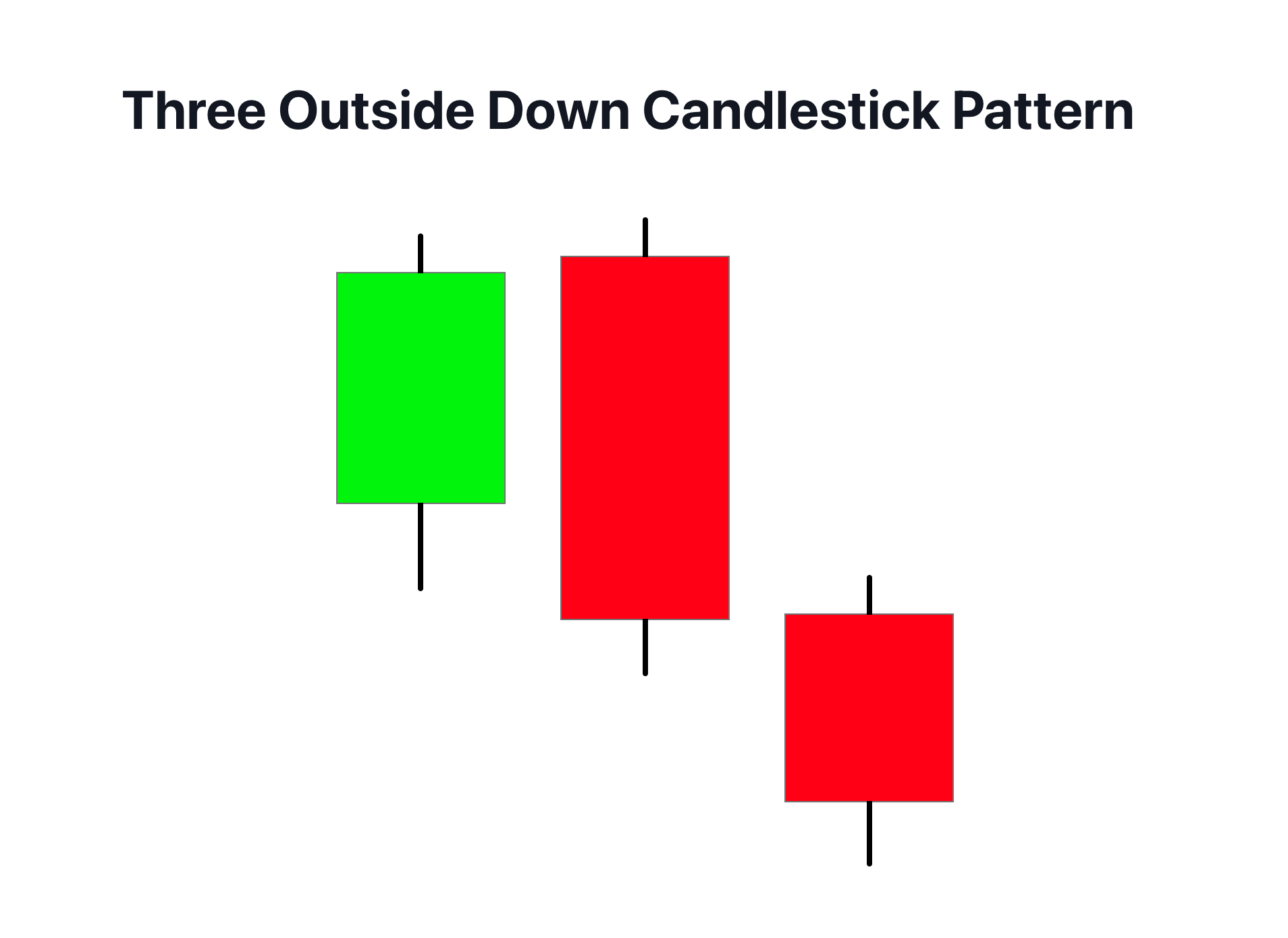

Three Outside Down is a bearish trend reversal candlestick pattern consisting of three candles. The first two candles of this candlestick pattern form bearish Engulfing. The Three Outside Down candlestick pattern is recognized if: The first candle is bullish and continues the uptrend;

Top Reversal Candlestick Patterns

The Three Outside Down trading pattern is a candlestick pattern that forms over three consecutive trading sessions. It is a bearish reversal pattern that consists of three candlesticks and is typically formed at the end of an uptrend or an extended price rally in a downtrend, where it may signal a potential price reversal to the downside.

How To Trade Blog What Is Three Inside Down Candlestick Pattern? Meaning And How To Use It

The three inside up pattern is a bullish reversal pattern composed of a large down candle, a smaller up candle contained within the prior candle, and then another up candle that closes.

Three Outside Down Bearish Candlestick Pattern ForexBee

In this video:we dive deep into the Three Outside Down Candlestick pattern trading strategy. Unlocking the secrets of this powerful pattern you will learn ho.

Three Outside Down

Three Outside Down is a bearish trend reversal candlestick pattern consisting of three candles. The first two candles of this candlestick pattern form bearish Engulfing. The Three Outside Down candlestick pattern is recognized if: The first candle is bullish and continues the uptrend;

Three Outside Up & Down Candlestick Pattern PatternsWizard

1. The market must decline for a three outside up pattern to appear. 2. The pattern's first candle will be black, signifying a downward trend. 3. A large white candle will be formed next. It will be long enough for the first black candle to be completely contained within its true body.

Three Outside down candlestick pattern PDF Guide Trading PDF

The three outside down candle pattern is a three-bar bearish reversal pattern. The pattern gets its name from its appearance on a candlestick chart—three candles, with the second being outside the first and the last moving down. Traders consider the pattern a bearish trend reversal, but history shows that volatility usually comes first.

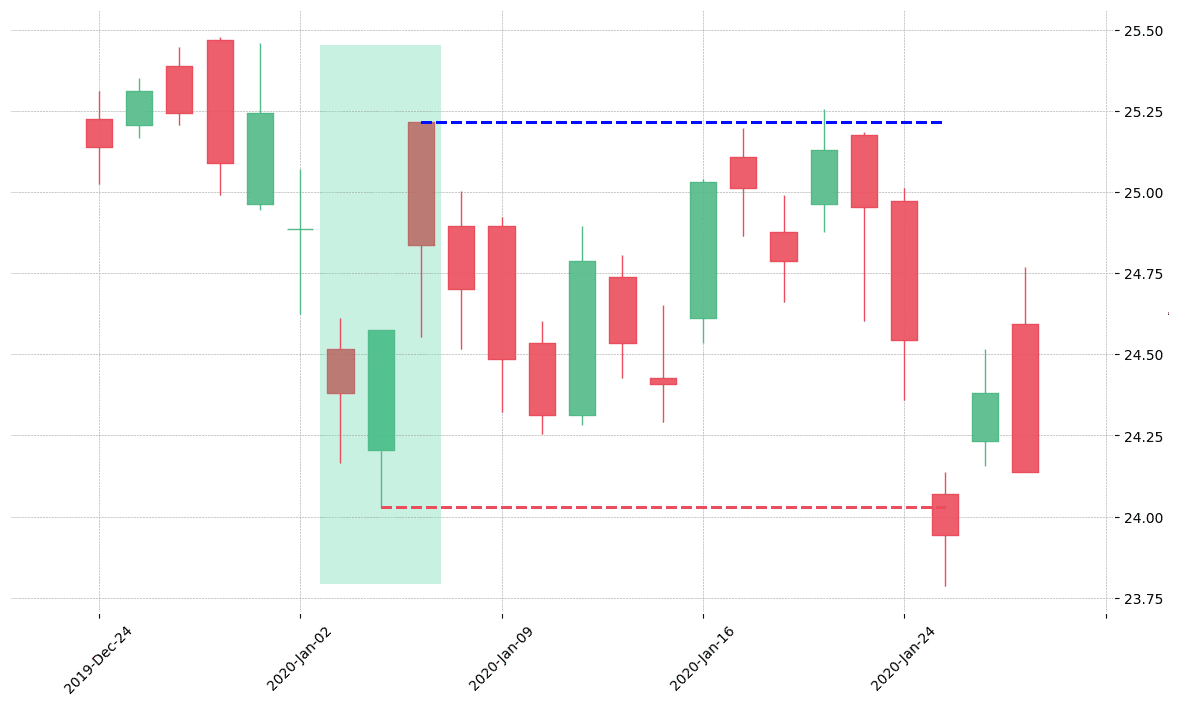

Three Outside Down Candlestick Pattern Example 2

The Three Outside Down is a Japanese candlestick pattern. It's a bearish reversal pattern. Usually, it appears after a price move to the upside and shows rejection from higher prices. The pattern is bearish because we expect to have a bear move after the Three Outside Down appears at the right location.

Three outside up and down candlestick pattern. Candlestick chart Pattern For Traders. Powerful

Three Outside Down: The Three Outside Down is a multiple candlestick pattern formed after an uptrend indicating bearish reversal. It consists of three candlesticks, the first being a short bullish candle, the second candlestick being a large bearish candle which should cover the first candlestick.

Three outside down candlestick pattern. Candlestick chart Pattern For Traders. Powerful bearish

The Three Outside Down Candlestick pattern typically occurs during an uptrend when the market has been experiencing bullish price action but it can also occur after a period of consolidation or sideways trading. The three outside down candlestick pattern occurs when there is a shift in market sentiment from bullish to bearish. The three outside.