Dribbble form_ui_kit_cover.png by John Howard

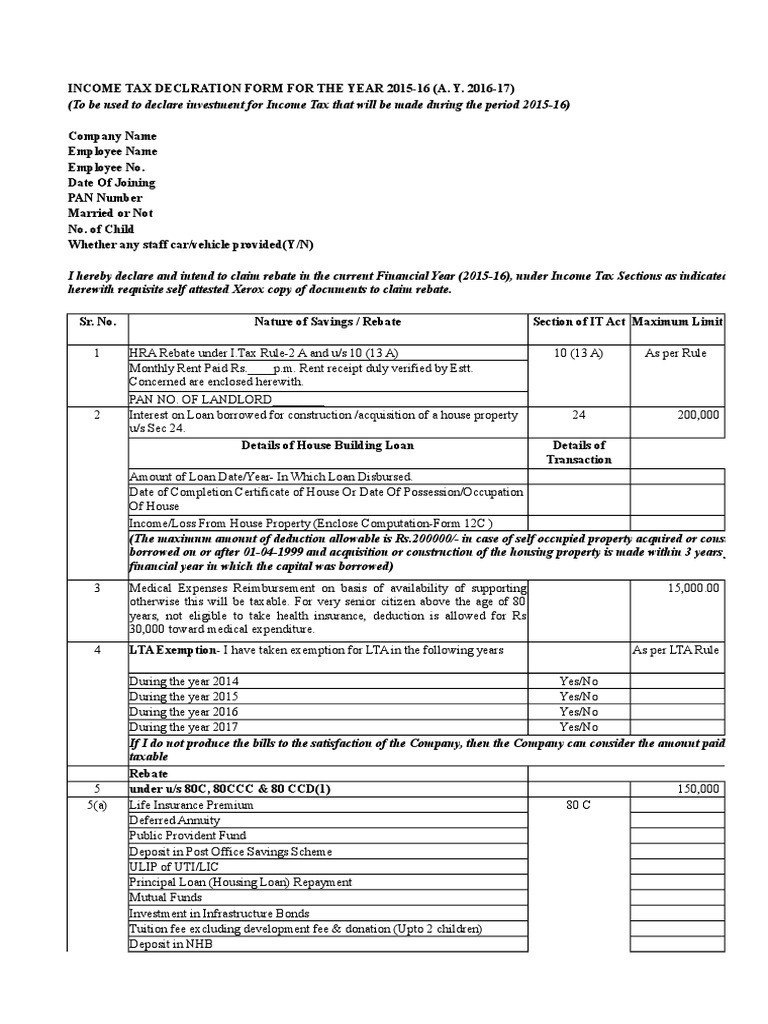

Depending on the size of the U.S. affiliate, a BE-12A, BE-12B, or BE-12C form must be filed. A BE-12C form is required if assets, sales and net income (loss) are all $60 million or less. This tutorial is intended for "small" BE-12C form filers of real estate investments with assets, sales, and net income (loss) all below $20 million.

FORM 12C HOUSING LOAN DOWNLOAD

(6) Add questions separating payables, receivables, interest payments, and interest receipts by foreign parents and foreign affiliates of foreign parents (FAFPs) on the BE-12B form. (7) Add a Part III to the BE-12C form to expand information collected on foreign ownership to better align the data collected on the BE-12 benchmark Start.

BE12 Benchmark Survey StepbyStep Guide to File

FORM BE-12C (REV 9/2022) Part I - Continued Page 3 1101 1 Yes No2 1 1 1163 0 1 ISI Code 1164 BEA USE ONLY 1 1299 4 Reporting period — Reporting period instructions are found in instruction 4 on page 15. If there was a change in fiscal year, review instruction 4.b. on page 15.

12C Medium

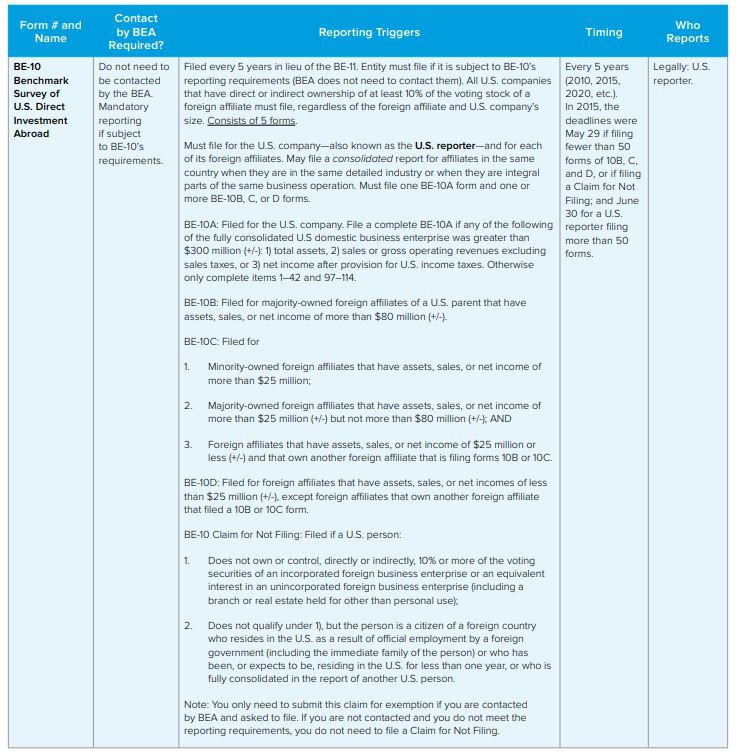

Form BE-12 is the comprehensive benchmark survey of foreign direct investment in the U.S., which BEA conducts every 5 years.. BE-12C is for other foreign-owned U.S. business enterprises that.

Redmi 12C (4GB+128GB 6GB+128GB)

The BEA provides three different versions of the Form BE-12 (designated as versions "12A," "12B" and "12C") based on a Reporting Company's total assets, sales or net income for its 2022 fiscal year.. BE-12C: This is the BEA form to be filed by a Reporting Company with total assets, sales or net income less than or equal to US.

How To Fill Form 12c Fill Online, Printable, Fillable, Blank pdfFiller

FORM. For the 2022 fiscal year, there are four forms of the BE-12 that can be filed to meet this reporting requirement: BE-12A, BE-12B, BE-12C, and BE-12 Claim for Not Filing. The BEA has provided a comprehensive decision tree to help filers determine which form to file.

repertoriu Imens friptură bot to fill google forms curgere înapoi Stradă

In summary, subject to the above determinations, filling out the BE-12C form is mandatory for companies incorporated (in any US state) in 2022 or earlier (LLC or Corp). This obligation will be required every five years, for years ending in 2 and 7.

XWORKS Small Form Factor Cases

Form BE-12 must be filed with the BEA by May 31, 2023, however the filing deadline is automatically extended to June 30, 2023 for respondents who use the BEA's eFile system, which is recommended.. The most basic Form BE-12C may be filed by any U.S. business enterprise that is an affiliate of a foreign parent and that has total assets, sales.

Oracle Forms 12c key next item not running on execute query Database

Form BE-12C: This form must be completed by a U.S. affiliate if none of the three items listed above exceeded $60 million (positive or negative) BE-12 Claim for Not Filing: This form must be completed by any U.S. person that is contacted by BEA but is not subject to the reporting requirements.

Redmi 12C Xiaomi UK

The reporting thresholds for Form BE-12A (the longest form) and Form BE-12B are $300 million and $60 million, respectively. All affiliates below $60 million will file on Form BE-12C (the shortest form). The smallest affiliates, those below $20 million, are only required to report a few items on Form BE-12C.

12C Home

BE-12C: Survey Form PDF Part III Overflow page PDF: BE-12: Claim for Not Filing PDF: BE-12: BE-12 Supplements XLSX To be used for overflow or in place of supplements on BE-12A, BE-12B, and BE-12C forms . Additional Documents. BE-12 Extension Requests; Guide to the 2022 North American Industry Classification System (NAICS)

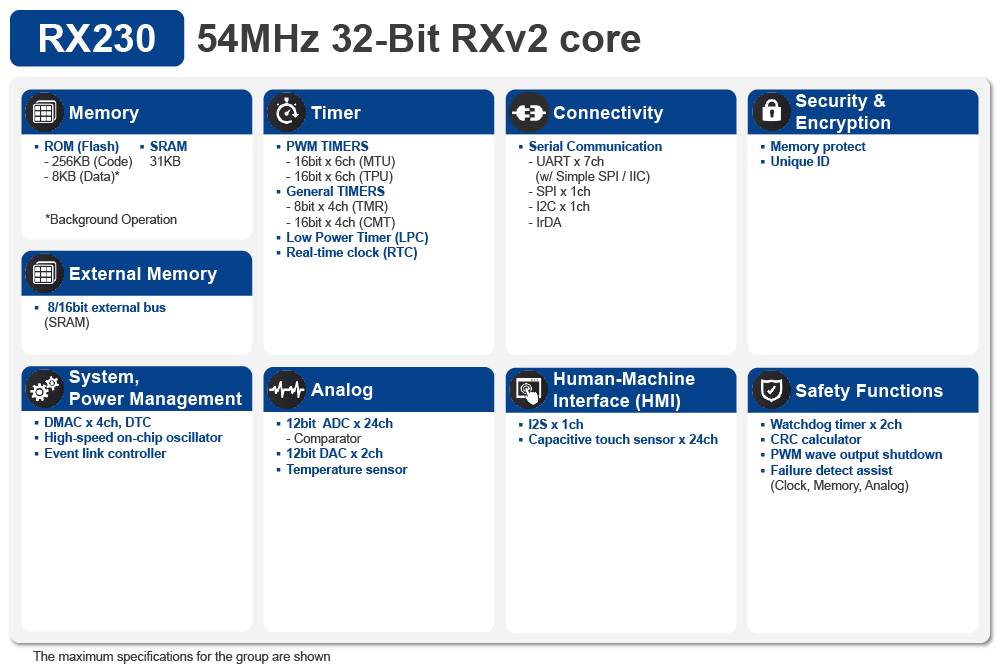

RX230 32 ビット RXv2 CPU コア、DSP/FPU を強化した低消費電力・高性能マイクロコントローラ Renesas

Form BE-12C. File for reporting U.S. affiliates owned by foreign parents at the end of the fiscal year that ended in calendar year 2022 if none of the following three items—total assets, sales or gross operating revenues excluding sales taxes, or net income (loss) after provision for U.S., State, and local income taxes—exceeded $60 million.

¿Qué es el FORM BE12C? 📋 YouTube

Form BE-12C. This form is filed for a U.S. affiliate that has total assets, sales or net income (loss) of $60 million or less (positive or negative). Changes to BE-12 Survey Forms. Compared with the prior BE-12 Benchmark Survey for fiscal year 2017, BEA has added, deleted and modified some items on the survey forms.

Fillable Online 20172023 Form BEA BE12C Fill Online, Printable

BE-12C - Filed by other foreign-owned US business enterprises that have total assets, sales or gross operating revenues, or net income of $60 million or less.. Adding questions on the BE-12A form to collect sales data related to the provision of cloud computing and data storage and digital intermediation services.

Blazor Server ファイルアップロードボタンをカスタマイズする

Form BE-12C. Form BE-12C is necessary for US affiliates where none of the three items mentioned above exceed $60 million in total, positive or negative. Form BE-12 Claim for Not Filing. The BE-12 Claim for Not Filing form is completed by individuals contacted by the BEA but who are not subject to the BE-12 reporting requirements mentioned above.

BE12 Form BEA 5Year Benchmark Survey on Foreign Direct Investment in

The Bureau of Economic Analysis (BEA) of the U.S. Department of Commerce requires an incorporated U.S. business enterprise1 or an equivalent unincorporated U.S. business enterprise in which a foreign person or entity owns or controls, directly or indirectly, more than 10% of the voting securities (a "Direct Investment") to file a report on its BE-12 Benchmark Survey of Foreign Direct.